Even if I have a good medical insurance in the Philippines, it doesn’t cover me whenever I travel abroad. So finding affordable and good travel insurance is one of my problems as a Filipino traveler.

Travel insurance is one of my biggest expenses as I travel full time for the past 8 years. I can travel without it of course, but I firmly believe it is something that every traveler must-have. That’s why I would rather spend money on insurance rather than take a risk without having any coverage. As I always tell my friends and readers, if you can’t afford travel insurance, then you can’t afford to travel.

It is something that you’d be thankful to have when something happens. That’s why finding SafetyWing is such a great help as it’s not only reliable travel medical insurance but also it’s affordable for long term travelers like me.

So is travel insurance really necessary?

First off, let’s discuss what is travel insurance.

What is travel insurance?

Travel insurance is a type of insurance that guarantees some form of compensation to cover medical expenses, flight delays, and cancellation and other losses incurred while traveling.

To put it simply, it provides you with coverage for unexpected events whether traveling domestically or internationally.

Why travel insurance is important?

There’s a big debate between travelers on the importance of travel insurance. Some people find it unnecessary but a lot of people also find it risky to travel without insurance. At the end of the day, it is a personal choice.

But this choice can be risky.

I’ve seen so many GoFundMe campaigns on Facebook from people who had accidents, while traveling overseas, who couldn’t afford to get proper treatment for the lack of money. And because they didn’t have insurance to cover these unexpected events, they had to resort to GoFundMe and relied on the generosity of strangers. And for most campaigns, the money they pooled wasn’t enough. And it resulted in expensive lessons.

I also know people who lost a lot of money on medical bills abroad because they thought they won’t need it because they are healthy and careful enough. But that’s why it’s called an accident. You’re only safe until it happens to you.

As an example, I have a friend who tripped while walking (yes, who would have thought right?) in a very safe city and broke her arm. But thanks to her travel insurance, she saved over $60,000 (or over Php3 millions) for emergency expenses.

So is it worth to take the risk?

SafetyWing – a travel medical insurance for long term travelers

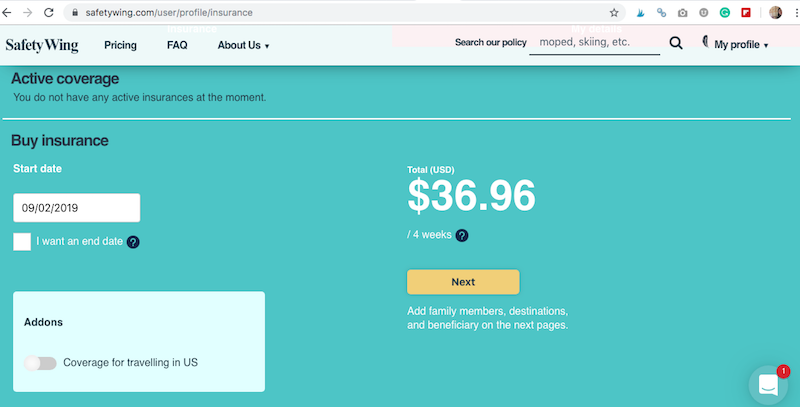

SafetyWing provides affordable travel medical insurance for everyone, especially for long term travelers and digital nomads. It is a subscription type of travel medical insurance that you can use continuously up to 364 days or until you decide to cancel it.

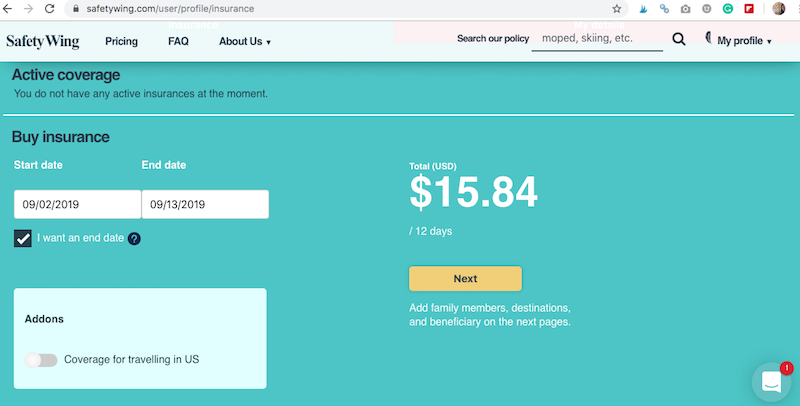

You can also choose to put an end date to your coverage if you don’t like the subscription model.

Things to note:

- It is only $37 for 4 weeks for travelers between 18-39 years old.

- The premium gets more expensive if you are traveling in the US and if you are older but this is quite common among travel medical insurance providers.

- You can sign up from anywhere even after leaving your country. This is something other insurance companies don’t offer.

- You can cancel at any time.

- They have a maximum limit of $250,000.

- There are a 5-day minimum and 364 days of maximum coverage. You can still renew your policy after 364 days.

- You are covered to travel anywhere EXCEPT North Korea, Iran, and Cuba.

Coverage

When choosing the right travel medical insurance, you have to ask yourself first. How much protection do you need? Do you want security from the worst possible scenario? Or do you want a very specific coverage? SafetyWing provides an extensive list of coverage and these can help you decide whether it is a good fit for you.

- Emergency Medical Evacuation

- Emergency Medical Treatment

- Medical Expenses (including Dental emergency)

- Repatriation

- Lost baggage

- Trip interruption and travel delay

- Natural Disaster accommodation and political evacuation

- Personal liability

- Accidental death and dismemberment

- Terrorism (for medical expenses only)

- Personal liability

Personally, the first few things I checked on the coverage are the emergency medical evacuation, emergency medical treatment and expenses, and repatriation. One of my greatest fears when traveling is getting into an accident and I’m in a remote place with no proper hospital. Getting an emergency medical evacuation can get you the help you need without worrying about the cost of medical evacuation.

With SafetyWing, they actually offer more than these basic emergency medical expenses. They are also the only travel medical insurance provider that I found so far that offer coverage for natural disaster accommodation, political and terrorism evacuation. And with political climate these days, you never know.

And if you are a sports fan and adventurous (as long as it’s not organized athletics or professional sports or activities), you can still be covered for any accident that occurred with some exclusions.

To learn more of their coverage, you can check it here.

Why I like SafetyWing

You can still get it even after you leave your country.

One of the annoying things about travel insurance companies is that they require you to get it before you leave for your trip. Sometimes, things happen and you forget. So it’s good to know that I won’t stress about forgetting to get my travel insurance – which happened a lot to me in the past.

It is affordable

For $37 for 4 weeks, it is one of the most affordable travel medical insurances in the market especially for a Filipino like me (and with my weak currency). I used to pay double and more for a one-month trip. And even if I’m pro-travel insurance, $70-100/ month for travel insurance is a lot of money that you can spend on experience.

And if you are traveling with a child (older than 14 days but less than 10 years old), the child insurance is already free. It is only free for one child per adult.

You can extend it

For full-time digital nomad like me, this lessens the stress of trying to guess how many days I should get for my next coverage. You see, most of the time, I don’t know when I’m going home. My 1-month planned trip can turn to 4 months or 6 or who knows. And this was my problem with my previous travel medical insurance providers as either you can’t extend with them (because you’re already outside of the country) or it’s a tedious process just to do so.

So before, I would always add another 15-30 days to my coverage just in case I decide to extend my trip. This means, I’m either losing money or losing coverage for the times I changed my mind. But with SafetyWing subscription model, I can just cancel my insurance coverage the moment I get home.

The claiming process

The claiming process is straight forward. You can just email them using the email they will provide and you can get an answer within 24 hours.

But do not take my word for it alone. You can also check what other people said about the company here.